by Prashant Kapadia/NHN

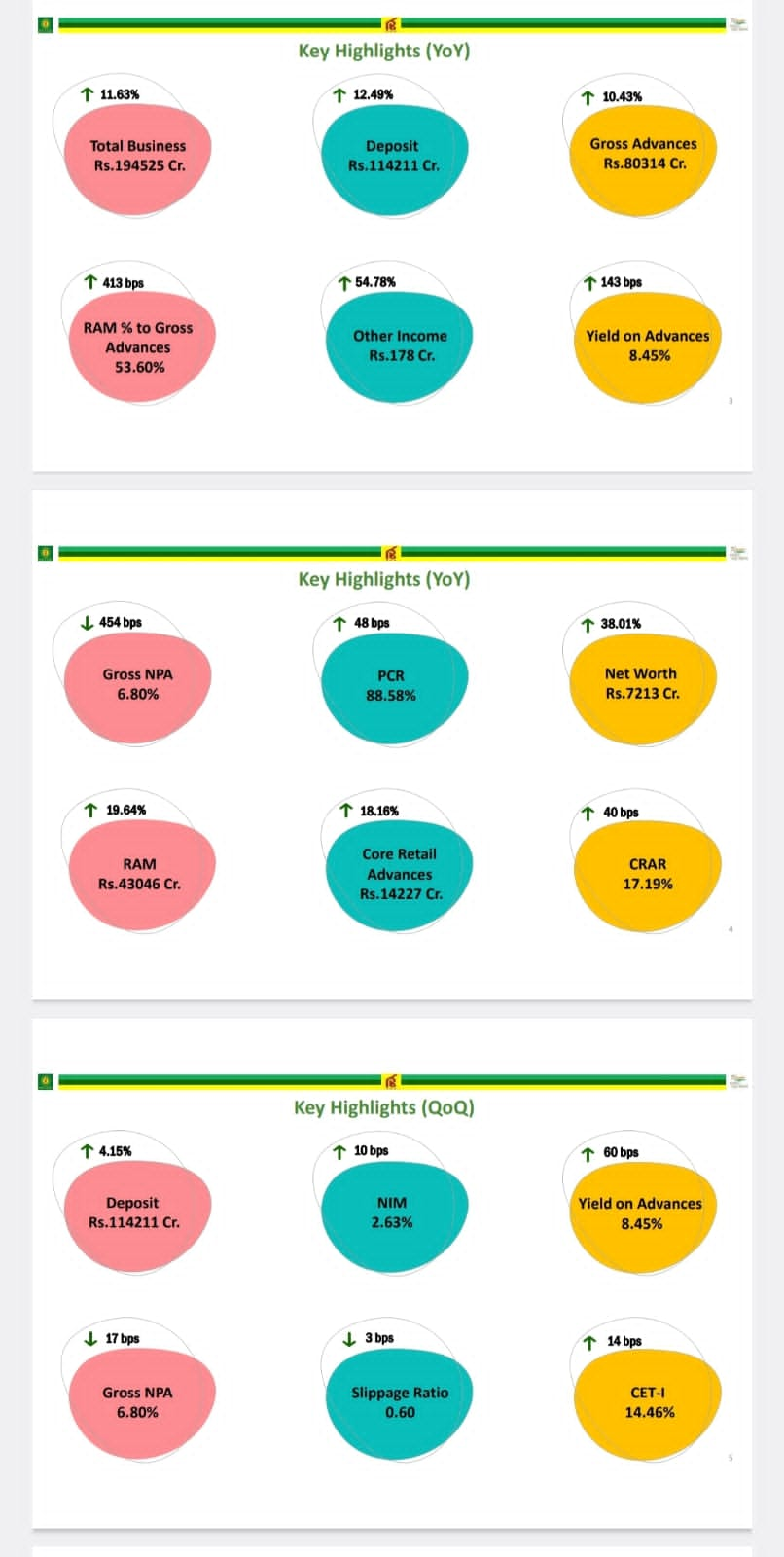

Punjab & Sind Bank, announced the Q1 results and posted a 25% year-on-year decline in their net profits. The profit after tax (PAT) of the bank dropped to ₹152.6 crore from 204.7 crore during the corresponding quarter previous fiscal. The asset quality of the bank improved as both Gross Non-Performing Assets and Net Non-Performing Assets declined during the April-June quarter.

Sequentially, there is a significant decline in the net profit of the bank as it plunged 66% from ₹456.99 crore during the quarter ending March 2023.

Punjab & Sind Bank’s earnings from interest jumped 28% to ₹2,315.7 crore during Q1FY24 from ₹1,800.4 crore during the quarter ending June 2023. Sequentially, the interest earnings rose 10% from ₹2,104.9 during the quarter ending March 2023.

The Gross Non-Performing Assets (GNPA) of the Punjab & Sind Bank declined from 11.3% during Q1FY23 to 6.8% during Q1FY24. Similar improvement was also recorded in Net Non-Performing Assets (NNPA) which plunged to 1.95% during Q1 compared to 2.56% during the corresponding quarter previous fiscal.

During the Q1FY24, the Debt to Equity ratio of Punjab & Sind Bank was at 0.28 while the operating margin declined to 10.3% as against 13.15% during the corresponding quarter last fiscal. The net profit margin of the bank also slipped from 10.6% to 6.1% during the quarter ending June 2023.

The Earning Per Share (EPS) of the bank stood at 0.23 (both basic and diluted) during the quarter ending June 2023.

Previous Article