Aeroflex Industries IPO, solely lead managed by Pantomath Capital, debuted today on 83% premium

by Prashant Kapadia/NHN

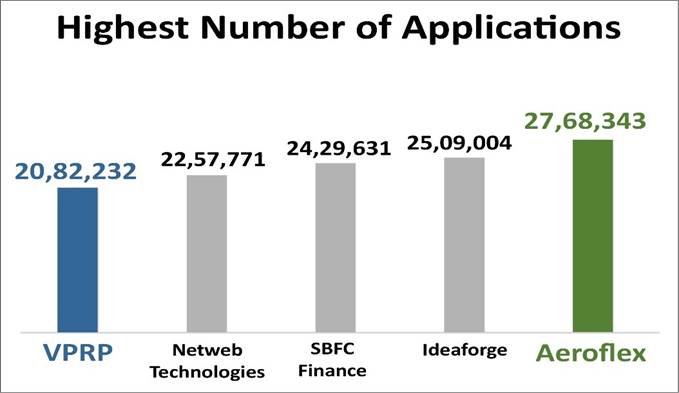

IPOs of Aeroflex Industries Ltd and VPRP Ltd had received responses of over INR 43000 Crores of subscription applications backed by exceptional institutional bids

-

Pantomath Capital was the Book Running Lead Manager to both the IPOs: Sole Lead ii Aeroflex and Co-Lead along with Choice Capital in VPRP Ltd.

-

Together with a Pre-IPO of Rs 76 Crores, Aeroflex and its Promoter, Sat Industries Ltd, raised a total of Rs 427 Crores.

-

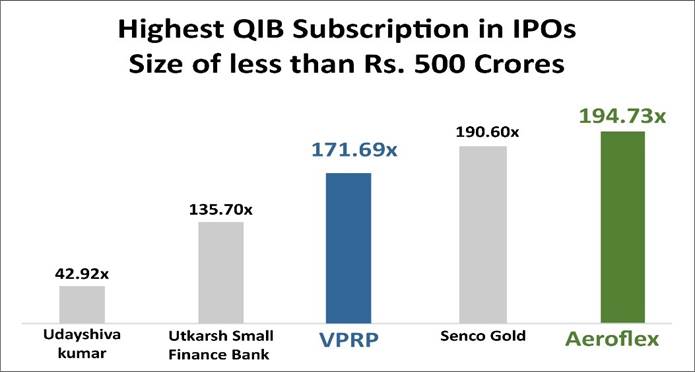

In addition to marquee anchor investors’ participation in both IPOs; QIB Portion in Aeroflex was subscribed over 194 times, and VPRP subscribed over 171 times.

-

VPRP Ltd IPO of INR 309 Crores garnered INR 19,150 Crores as it was subscribed over 87 times.

-

Aeroflex Ltd IPO of INR 351 Crores garnered INR 24,500 Crores as it was subscribed over 97 times.

Mumbai, Thursday, August 31, 2023: Mumbai-based Aeroflex Industries made a stellar listing debut today on BSE at a premium of 82.78% at Rs.197.40. Pantomath Capital is the sole Book Running Lead Manager in Aeroflex Industries IPO. Together with Pre-IPO of Rs 76 Crores, Aeroflex and its Promoter, Sat Industries Ltd, raised a total of Rs 427 Crores.

On Tuesday, September 5, 2023, Jodhpur-based VPRP Ltd will be listed on BSE and NSE subject to receipt of necessary approvals. Pantomath Capital is the co-lead book running lead manager along with Choice Capital to this IPO.

Mahavir Lunawat, Managing Director of Pantomath Capital Advisors Private Limited, lead manager of both the IPOs, said, “We are excited having received an overwhelming response from investors. We have garnered gross subscription (before rejection) of more than Rs. 43,000 Crores in both the IPOs of Aeroflex and VPRP. This level of participation demonstrates the market depth and also the favor primary issuances get from investors. Notably, the subscription was fueled by institutional demand, which is even more encouraging.”

Aeroflex Industries Ltd and VPRP Ltd together had garnered INR 43,650 Crores of gross subscriptions. Aeroflex IPO was subscribed 97.11 times in which QIB portion was subscribed 194.73 times. On the other hand, VPRP Ltd IPO was subscribed 87.82 times in which QIB portion was subscribed 171.69 times.

Details |

Aeroflex |

VPRP |

Total |

IPO Size (INR Crores) |

351 |

309 |

660 |

Subscription Garnered (INR Crores) |

24500 |

19150 |

43650 |

Subscription in Times |

97.11 |

87.82 |

|

QIB Subscription Times |

194.73 |

171.69 |

|

Number of Applications |

27,68,343 |

20,82,232 |

48,50,575 |