SBI Mutual Fund launches SBI Automotive Opportunities Fund

by Prashant Kapadia/NHN

The New Fund Offer opens on Friday, May 17, 2024, and closes on Friday, May 31, 2024.

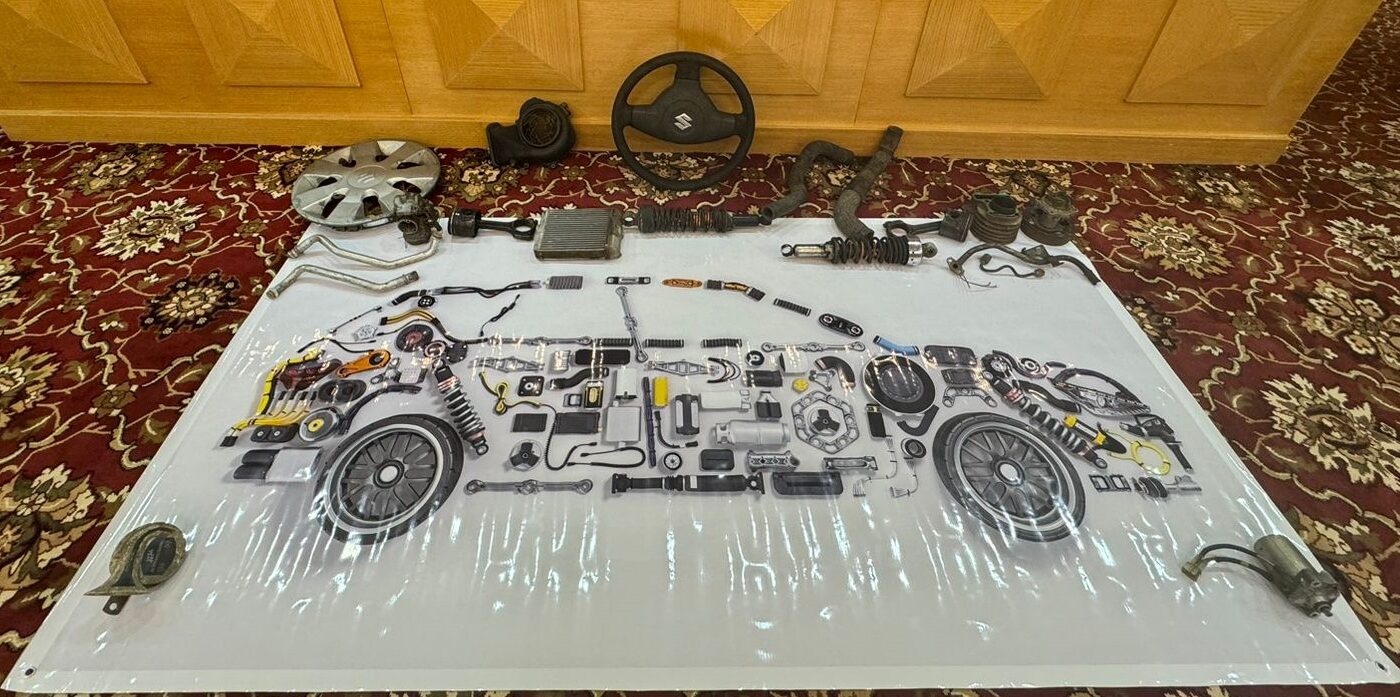

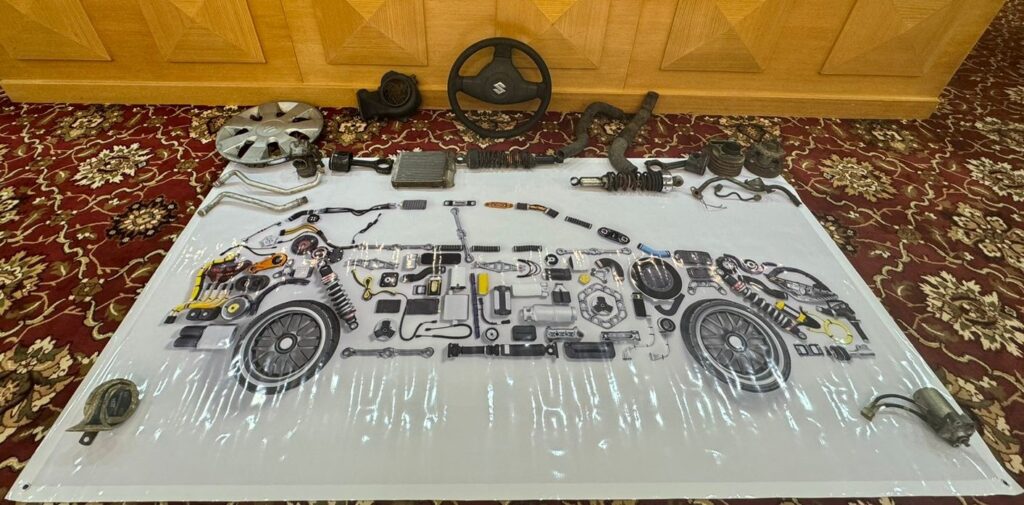

An opportunity to Investment in equity and equity related instruments of companies engagedin and/or expected to benefit from the growth in automotive & its allied business activities theme.

Mumbai, May 16, 2024: SBI Mutual Fund, India’s largest fund house, announces the launch of the SBI Automotive Opportunities Fund, an open-ended equity scheme following automotive & allied business activities theme. The investment objective would be to generate long-term capital appreciation to unit holders from a portfolio that is invested in equity and equity related instruments of companies engaged in automotive & allied business activities theme from the domestic as well as global universe. However, there can be no assurance that the investment objective of the Scheme will be realized. The fund would be benchmarked to the Nifty Auto TRI.

Mr. Shamsher Singh, Managing Director & Chief Executive Officer, SBI Funds Management Limited, said, “Today India is the world’s 3rd largest automobile market. The Indian Automotive sector presents an attractive opportunity as domestic demand and auto exports have been drivers of growth. Electric mobility and rise of logistics & passenger transportation provide inflection points for the industry. The SBI Automotive Opportunities Fund is a wonderful opportunity for investors who would like to benefit from the growth of the entire automotive ecosystem as this sector is poised to take India to new places.

”Mr. D P Singh, Deputy MD & Joint CEO, SBI Funds Management Limited, said, “I am pleased to present the SBI Automotive Opportunities Fund to investors who are keen to add a thematic offering to the satellite portion of their portfolios. The Indian Automotive Industry is running in top gear as our country is a force to be reckoned in terms of production of vehicles and auto exports while our burgeoning domestic market, demands safer and premium vehicles. In addition, manufacturing of auto parts and ancillaries contribute to almost 30 percent of the manufacturing ecosystem providing wealth creation opportunities for investors in the long-term. I believe policy reforms and a defined roadmap with the industry provide momentum and an opportunity for investors to benefit from India’s growing automotive ecosystem.”

The fund would predominantly invest i.e., 80%-100% of its assets in Equity and Equity-related instruments of companies engaged in automotive & allied business activities theme (including equity derivatives), with the balance assets as per the following allocation: a) 0 – 20% in Equity and Equity-related instruments of companies other than above (including equity derivatives) b) 0 – 20% in Debt and Debt-related instruments (including securitized debt {upto 20%} & debt derivatives) and money market instruments including tri-party repos c) 0 – 10% in Units issued by REITs and InvITs, with the exposure in line with SEBI limits specified from time to time. The fund may seek investment opportunities in foreign securities including ADR/GDR/Foreign equity and debt securities and overseas ETFs subject to Regulations. Such investment may not exceed 35% of the net assets of the scheme and will be in line with the maximum limits available from time to time. The Fund Managers for the SBI Automotive Opportunities Fund would be Mr. Tanmaya Desai and Mr. Pradeep Kesavan (dedicated fund manager for overseas securities).

About SBI Funds Management Limited (SBIFM), the asset management company of SBI Mutual Fund: SBIFM is a Joint Venture between State Bank of India, India’s largest bank, and Amundi, Europe’s largest asset manager and one of the world’s leading asset management companies. SBIFM is acting as the asset management company of SBI Mutual Fund and also offers Discretionary, Non-Discretionary and Advisory Portfolio Management Services in addition to Alternative Investment Fund offerings to various High Net worth Individuals, Corporates, and Institutional Investors amongst others. SBIFM was the first asset management company in the mutual fund industry to sign the CFA Institute of Asset Manager Code of Conduct and is also the signatory of the United Nations Principles for Responsible Investment (UN PRI).SBI Mutual Fund is the leading mutual fund house in the country, managing an AAUM of over Rs. 9.14 lakh crore as on March 31, 2024 (source: AMFI).