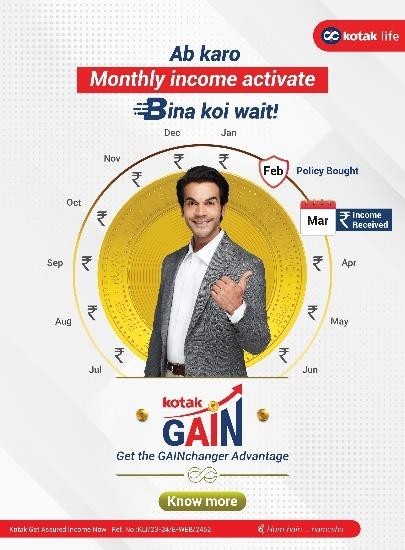

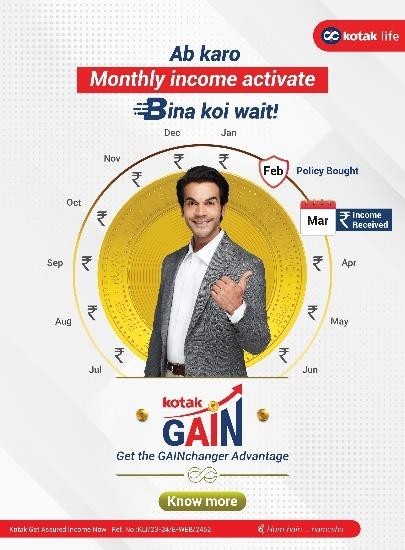

Kotak Mahindra Life Insurance Launches Kotak G.A.I.N

A comprehensive long-term savings product designed to receive payouts from the first month of policy issuance

by Prashant Kapadia/NHN

Mumbai, March 6, 2024: Kotak Mahindra Life Insurance Company Ltd (“Kotak Life”) today announced the launch of Kotak G.A.I.N, a non-linked participating plan which offers long-term saving / income. The product is designed with options to receive payouts from the first month of policy issuance. Kotak G.A.I.N empowers customers with a comprehensive solution for achieving their financial needs by offering flexible options for customised payouts for a long-term regular or lump sum income at maturity.

G.A.I.N is a step towards financially empowering individuals and in line with the brand promise, ‘Hum hain… hamesha’, which underscores the company’s commitment to standing by customers at every stage of their life journey.

Mahesh Balasubramanian, Managing Director, Kotak Mahindra Life Insurance Company Limited said, “Delivering value to our customers through protection and long-term savings has been our core purpose at Kotak Life. G.A.I.N aims to empower customers with a comprehensive solution that provides long-term income and ensures robust protection for their loved ones. All three variants of Kotak G.A.I.N will offer customers a blend of long-term income as well as life cover. We believe

G.A.I.N will play a significant role in helping individuals achieve their financial goals with confidence and peace of mind.”

Salient Features of Kotak G.A.I.N |

||

Early Income Option |

Paid-up Addition Option |

Premium Saver Option |

Receive regular income instantly from the 1st month onwards for monthly payout mode and 1st year onwards for annual payout mode. |

The Income benefits will be used to purchase Additional Sum Assured throughout the Policy Term and receive it as lump sum / withdraw as per convenience. |

Receive Cash Bonus from the end of the premium payment term. There is a Guaranteed Loyalty Additions (GLAs) payable in the Policy that can also be used to pay the last two yearspremiums. |

Entry Age:a. Min: 90 Daysb. Max:i. For Policy Term: 85 – Entry Age: 50 years for premium payment term (PPT) 8 / 55 years for PPT 10 & 12ii. For Policy Term: 40 years: 44 years |

||

Maturity Age: Min 40 Years and Max 85 Years |

||

Maturity Benefit: Return of Premium + Terminal Bonus |

||

Policy Term: 85 years minus Entry Age or 40 years (Fixed) |

||

Premium: Min: Rs. 50,000 |

||

Premium Payment Term: 8, 10, 12 years |

||